Learn about the latest News & Events for New Britain, CT, and sign up to receive news updates.

Get Issuer Alerts

Add this issuer to your watchlist to get alerts about important updates.

Learn about the latest News & Events for New Britain, CT, and sign up to receive news updates.

Upcoming Events

No upcoming events. Add this issuer to your watchlist to get alerts about important updates.News & Press Releases

View Proposed Budget Below

Mayor Erin Stewart and City Assessor Michael Konik recently announced that the City of New Britain’s Grand List has grown for the eleventh year in a row increasing an additional .73% in 2023 after record 40.5% growth in 2022. The Grand List is an aggregate valuation of taxable property throughout the City of New Britain and is used to calculate the City’s tax rate. New Britain welcomed 133 new businesses this past year.

“To put it simply, were booming,” said Mayor Erin Stewart. “Our pro-growth policies are working. We are reinventing this community, restoring the pride of our glory days, through a modern 21st century approach - creating a better City for residents, for businesses, and for visitors. I am so proud of the ongoing efforts of my administration, for doing the good, hard work in fostering a better economic environment for our City, and for embracing the promising prospect of new possibilities.”

The City of New Britain’s Mill Rate in Fiscal Year 2023-2024 was 38.2% on real estate and personal property, and 32.46% on motor vehicles. At this moment, the amount of tax revenue is not finalized and the actual amount of tax revenue that is generated will not be determined until the City completes its budget process in late spring.

The personal property portion of the Grand List increased in value by $54,190,440 or 15.22%. This increase from 2022 can be partly attributed to new businesses opening up as well as assessment increases on improvements to existing businesses.

The motor vehicle portion of the Grand List declined by 4.99%, or $23,134,382. The number of passenger vehicles decreased in number by 221 and the average passenger vehicle assessment decreased by 5.57%. This decrease in car values is due the fact that for the first time in about three years, used car values are depreciating. The inventory of new and used cars has increased and caused values to decline.

Real estate decreased by $789,046 or 0.02%. This is in line with the historical tendency for the realestate grand list to decrease in the year after a revaluation. The impact of the revaluation was partially offset by increases to assessments which include partial construction of the Brit and the Highrailer downtown developments, as well as the construction of Kingz Carwash and the new Sherwin Williams property. Six new residential buildings were also constructed in the last year and numerous other properties were remodeled or significantly improved. The Assessor’s Office performed 628 visits toproperties regarding construction permits and 812 properties were inspected to either verify sales or to review property listings

On the 2023 Grand List, the City’s Top 10 Taxpayers and their net taxable assessment are as follows:

1. Connecticut Light and Power (Utility) - $90,190,390

2. Pebblebrook Apartments LLC (Apartments) - $34,132,070

3. Connecticut Natural Gas Corporation (Utility) - $20,833,540

4. Corwest Plaza Power LLC (Retail) - $17,357,550

5. Jubilee Equities LLC (Apartments) - $15,726,200

6. Costco Wholesale Corp (Retail) - $14,972,380

7. Corbin Pinnacle LLC (Apartments)– $14,600,930

8. Paramount Plaza at New Brite LLC (Retail) - $13,365,660

9. Stanley Black & Decker Inc. (Office/Industrial) - $12,341,485

10. C R Stonegate LTP (Apartments) - $11,619,300

The Grand List is used to calculate the City’s tax rate and corresponds to the tax bills that are payable beginning in July 1, 2024.

The beginning of each year is one of my favorite times because it is always a chance to take stock of all we have accomplished together while looking forward to the future with hope and excitement for all the positive changes that are still ahead for our great City. Since I took office I have worked tirelessly to transform New Britain block-by-block in order to restore the vibrancy so many of us remember from decades ago, and this year is no exception. I am extremely proud of the progress we have made together, but I cannot wait to share the successes that are still to come with all of you.

Creating a diverse housing stock to meet the ever present need for quality living options here in New Britain remains a top priority to help retain and attract residents. This coming year we will see the beginning, continuation of, and completion of so many transformative housing projects in neighborhoods throughout the City. Downtown New Britain will see the completion of both The Brit and The Highrailer, two sister buildings that will provide the unique options that people of all ages look for these days when choosing a place to live. Also this year we will be seeing the construction of The Strand, another attractive development project right in Downtown New Britain that will transform an empty parking lot into a beautiful new apartment building that pays tribute to the historic Strand Theater that once stood in that exact same spot. These projects will add to the vibrancy of Downtown New Britain by bringing foot traffic to the heart of our City unlike anything that we have seen in decades, enhancing our community and bringing an influx of customers to our businesses.

New Britain has always been a blue collar City, and we take pride in that, so I believe it is critical to provide housing options that are affordable for residents of all different income levels. To that end I am extremely excited about the complete renovation of Mount Pleasant, a multi-phase project kicking off this year that will bring approximately 251 brand new affordable housing units for those who currently live there. This year we will also see the continuation of the complete redevelopment of 321 Ellis Street, the old old Landers, Frary & Clark factory. This project will transform this building that has been underutilized for many years into 154 units geared towards senior and affordable housing. This will help fill a major need for this type of housing in our City, and should be completed by early 2025.

About two years ago we demolished the old St. Thomas Aquinas High School building and remediated the entire site in order to make space for 11 brand new single family homes. This year we will see the construction of those beautiful homes, representing a unique opportunity for first time home buyers to put down roots here in our City. What was once the site of a dangerous eyesore will now be a site of growth and opportunity for the residents of New Britain.

Throughout my time as Mayor I have held steadfast in the belief that our students need modern, safe school buildings that are able to meet the needs of 21st century education in order to have the best chance at academic success. My administration has overseen the renovation of multiple schools over the years like Gaffney, Chamberlain, and Smalley, and 2024 will be no different! This summer we plan to break ground on the extensive renovation of Holmes Elementary School. This $70 million project will provide the students and staff of that school with the learning facility they deserve, equipped with all the necessities for success inside the classroom and beyond.

2024 will bring continued improvements to our infrastructure, which has such an impact on our residents’ day-to-day quality of life. Our Public Works Department will continue working on $1.5M worth of streetscape improvements to the heart of our “Barrio Latino” neighborhood which will make Arch Street look better with street trees, sidewalk improvements for pedestrians, slow down traffic, and help support the local businesses. Construction will also begin on streetscape improvements to John Downey Drive, which is arguably one of the most important business corridors in the City. The road itself is over 50 years old and in major need of repairs so we are using a $3.2M grant from the State for improvements that will improve the look, functionality and safety of this major road. The road will be narrowed and repaved to reduce speeding, new sidewalks and a paved multi-use trail will be added, and street trees will also be planted down the entire length of the road.

Our dedicated Public Works Staff will be able to execute these projects and meet the day-to-day needs of our residents from the brand new Public Works Yard that we will celebrate the opening of this year in the Pinnacle Heights Business Park. This $20 million investment will result in a facility capable of housing all public works operations and maintenance. It will also include storage buildings for equipment and vehicles so we will be able to store our vehicles in shelters, prolonging the life of these very expensive trucks.

The buzz of activity never stops here in New Britain, and I am always focused on making this City the absolute best it can be for all who live, work, and visit here. I hope you are just as excited as I am for all the great things to come this year, and share in my vision for leading New Britain towards the bright future that we all deserve. Here’s to a great year!

Management of the City’s finances is arguably my biggest responsibility as Mayor, and this includes creating the City’s operational budget each year. I have always viewed the annual budget process as comprising three key components; 1) cutting expenses, 2) managing our debt, and 3) growing our revenues. Remaining laser focused on this approach has allowed my administration to climb out of the $30 million deficit that existed when I first became Mayor, and it is exactly what protected us against financial demise in the face of extremely challenging economic times during this year’s budget process.

This was a particularly challenging budget process due to having to navigate the impact of unforeseen economic factors that were well outside of our control, but I am proud of the final product. The budget that has was officially adopted for Fiscal Year 2023-2024 by the Common Council during a special meeting on June 7th maintains our City’s financial stability even on the heels of unprecedented economic times. It includes an unprecedented $5 million increase in funding from the City to the public school district here in New Britain. The Consolidated School District of New Britain will also be receiving an additional $3.6 million in funding from the State of Connecticut in FY 24 and an estimated $8.2 million in FY 25.

We have all seen the rising costs of nearly everything, whether its eggs in the grocery store, or the materials needed to make repairs to your home. Unfortunately, the City of New Britain’s financial obligations were not immune to this trend, adding to the challenges of this budget cycle. For example, our contributions to the Municipal Employee Retirement Fund increased by $2,189,264, Police and Fire Pensions increased by $1,089,493, the cost of our medical insurance increased by $1,011,562, and the cost of our contractual obligations increased by $705,467. The City’s Debt Service payments also increased by $2,581,654.

I am happy that the Common Council passed my budget without any changes. This budget is fiscally sound, financially responsible, and makes major investments in education. In addition to the added $5 million to the Board of Education, this budget also funds the financing of the $70 million complete renovation of Holmes Elementary School, it avoids layoffs, meets all of the City’s fiduciary obligations, and puts $2.5 million in the Tax Stabilization Fund to help ensure continued protection for our taxpayers for the next 2 years.

Financial stability is a journey, not a destination, and it takes constant vigilance. Responsible fiscal management has been a cornerstone of my administration. The positive results of our efforts can be seen in many areas, most notably in our grand list which increased for the 10th year in a row this year and by an astonishing 40%. This new budget will shield residents from significant financial burden due to our increased property values, while still increasing investment in education, providing the quality of life our residents deserve, and maintaining the level of services this community expects from its government.

In accordance with the New Britain City Charter, I recently presented my proposed budget to the Common Council during the first Council meeting of April. Over the past several weeks I have been pouring over budget requests and crunching numbers until I was able to create a budget for the City of New Britain that minimizes the financial impact of the state-mandated revaluation process on taxpayers, while responsibly balancing the wants and the needs of our community.

This was certainly one of the most challenging budgets I have ever done, largely due to the mandatory reval that came in the midst of a volatile market and rising inflation. While these factors were outside of my control I still had a duty to protect our taxpayers as much as possible, which is why I am proud to have been able to lower the mill rate by 23% from 49.5 to 38.2. This new proposed mill rate will shield residents from significant financial burden due to increased property values, while still increasing investment in education, providing the quality of life our residents deserve, and maintaining the level of services this community expects from its government.

Last year at this time I wrote a column about how the City of New Britain was finally able to reach a place of financial stability, and my proposed budget for this year maintains that stability even on the heels of unprecedented economic times. The budget I proposed to the Common Council responsibly balances the needs and wants of our residents while providing an additional $5 million to the Board of Education, funding a $70 million complete renovation of Holmes Elementary School, avoiding layoffs, meeting all of the City’s fiduciary obligations, and putting $2.5 million in the Tax Stabilization Fund to help ensure continued protection for our taxpayers in years to come.

Now that I have presented my proposed budget to the Common Council, Council members have until June 7th to make any changes and adopt a final budget. Each subcommittee will review my proposed budget during their public meetings, and then the Council will come back together to create the final budget document. Residents can view my budget presentation under the Mayor’s Office tab on the City’s website at www.newbritainct.gov.

Fiscal responsibility has been a cornerstone of my administration, and the proposed budget I put forth to the Common Council this year reflects that. My primary responsibility as Mayor is to oversee the financial wellbeing of our City and ensure the taxes our residents pay with their hard-earned money are spent in a way that results in the greatest positive impact for the entire community. This is a responsibility I take incredibly seriously, and I feel this budget will continue to give us all the quality of life we have come to expect, while maintaining affordability for the blue-collar, working class residents who are truly the heart and soul of this great City.

New Britain, CT – Mayor Erin Stewart and City Assessor Michael Konik announced today that the City of New Britain’s Grand List has shown an increase of 40.5%. The Grand List is an aggregate valuation of taxable property throughout the City of New Britain and is used to calculate the City’s tax rate. 188 new businesses came to New Britain during the tenth consecutive year of Grand List growth for the City.

“New Britain is in the midst of a transformation unlike anything that’s been seen in years, and our grand list growth mirrors this exciting economic turnaround,” said Mayor Erin E. Stewart. “Under my administration we have built a business friendly environment that is focused on improving our financial conditions. I have long said that financial stability is a destination that is only achieved through constant vigilance.”

In 2022 the City of New Britain underwent a state mandated revaluation process, which came at a time of inflation, high demand, low inventory, and favorable interest rates. As a result the City will reevaluate the current mill rate as part of the budget process that is now underway. The City budget that is finalized in the Spring of 2023 will likely reflect an adjusted mill rate, so residents are encouraged to not apply their new property value to the current mill rate because it will reflect an inaccurate representation of taxes owed.

Based on a mill rate of 49.50 for real estate and personal property and a mill rate of 32.46 for motor vehicles—along with a tax collection rate of 100 percent—the increase in the Grand List equates to a potential addition of $55.9 million in additional tax revenue. It is important to note this amount of additional tax revenue for the City is not final and actual amount of tax revenue cannot be determined until the City completes its budget process in the spring.

“I fully expect to lower the current mill rate of 49.50 to equalize the tax burden on all payers,” said Mayor Erin Stewart.

The personal property portion of the Grand List increased in value by $1,434,870 or 0.67%. This increase from 2021 can be partly attributed to business owners adjusting to a post COVID-19 pandemic work environment.

The motor vehicle portion of the Grand List increased by 8.94%, or $36,156,660. The number of passenger vehicles increased in number by 1,126 and the average passenger vehicle assessment increased by 4.80%. This increase in car values is due to ongoing complications in the wake of the COVID-19 pandemic. There continues to be significant shortages in the chips that go into cars as well as other materials, coupled with increasing inflation and supply chain issues.

Real estate increased by $1,104,530,575 or 50.15%. Property value spiked during the state mandated revaluation process the City went through this year due to high demand, low inventory, and favorable interest rates. The Assessor’s Office revalued all 17,000 properties throughout the City as part of the revaluation process.

It’s hard to believe, but later this month I will present my ninth budget to the Common Council since being first elected “way back” in 2013. Anyone who has even remotely followed the work we’ve been doing over the past eight and half years knows that our City’s finances have always been my top priority, and when you look back and see just how far we have come, it’s not hard to understand why. Shortly after I first took my oath in November of 2013, I was informed that New Britain was facing a deficit of nearly $30 million dollars. From that moment forward, my mission as Mayor was clear: getting us back on the road to financial stability and responsibility.

It was a harsh reality to accept, one that would mean making tough and unpopular decisions. I had to get comfortable with the idea that, if I did my job the right way, it might very well mean that I was a one-term mayor. But I also knew that I had been given this responsibility for a reason and as long as I was upfront and honest with them, our residents would understand and rise to the challenge.

A complete overhaul of the City’s finances requires three legs – think of a stool. If you break one of the legs, the stool falls over. The three legs of New Britain’s financial stool were: 1) cutting expenses, 2) managing our debt, and 3) growing our revenues. If we were going to climb our way out of that deficit, it was going to take all three legs of the stool to get us there.

The first thing we did was restructure our workforce. We reconfigured how City Hall operates, streamlined and created efficiencies wherever possible, and partnered with our city employee unions to achieve significant savings when it comes to personnel costs and benefits.

Next, we developed a multi-year strategy for actively managing our debt. In 2013, the annual increases in the City’s debt payments for 2014 and beyond were so large that they threatened to bankrupt us. So we took advantage of the very low interest rates at the time and began a series of restructuring transactions to give us the breathing room we needed to get our budget under control and also to begin attracting new investment to our City so that we could grow our tax base organically. On March 26, 2022, the Common Council approved what I believe will be the final piece of that restructuring and will leave New Britain with something it hasn’t had in almost 20 years – a debt profile that slopes down, not up. Incidentally, I’m very proud that every transaction we’ve executed as a part of this strategy received bipartisan support.

Finally, we placed a command focus on creating an environment where businesses large and small want to locate and invest. We’ve partnered leaders at all levels of government to bring millions back into New Britain through transit-oriented development initiatives, actively marketed the City to CEOs and entrepreneurs alike, and continued to invest in our own critical infrastructure. The result? Last year, I signed a 2% tax cut into law – the first one in over fifteen years. Later this month, my budget proposal will make that tax cut permanent.

Cut expenses. Manage our debt. Increase our revenues. Those were the three legs of the stool we built back in 2013 and used to climb out of that $30 million-dollar hole. It’s taken a long time, but anything worth doing always does. Now it’s up to the people of this City to continue holding their elected officials accountable and make certain that we never end up in position like that again.

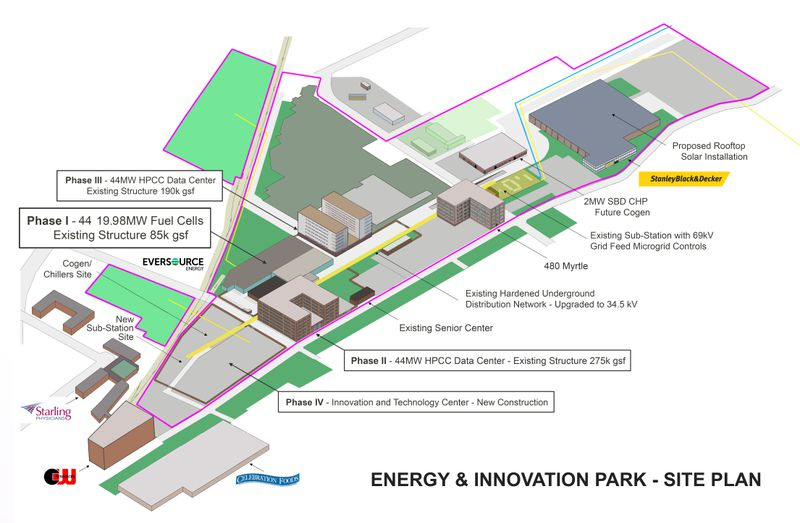

Speaking on the wet concrete floor of a dark ex-factory from the World War II era, Gov. Ned Lamont and New Britain Mayor Erin Stewart proclaimed that the building will soon be the first stage of a cutting-edge energy and tech project.

“What this is going to do for the city of New Britain is transformative — a few hundred jobs to start, thousands of jobs when it’s completed,” Stewart said.

“This center is going to become one of our largest taxpayers virtually overnight,” she predicted.

At its construction groundbreaking, EIP LLC said it is spending $100 million to bring 44 Connecticut-made fuel cells to the building. By the end of 2020, the plant will produce nearly 20 megawatts of power for the local energy grid, the company said.

Lamont said the project represents the best of entrepreneurship, and predicted that an attached data center — planned as a later stage — will draw the biggest names in technology.

"This will be the data heart for Google, Amazon and Microsoft. It’s amazing, this is ‘the cloud,’ " Lamont said, looking around the spartan industrial building of bare pipes, tubes, conduits and girders. “I thought ‘the cloud’ was more heavenly than this.”

The state this summer agreed to $55 million in tax credits for the project, which developers said would make Connecticut competitive in the drive to land high-tech, data and green energy businesses.

Mark Wick, a partner in EIP, acknowledged that the company doesn’t yet have contracts with companies such as Amazon, which require massive amounts of digital data storage that’s both secure and accessible. The data center is also a later stage of the planned multi-year, $1 billion project.

The plan is to remodel a few long-vacant Stanley factories and build several new buildings on what was a huge industrial tract along Myrtle Street. The land is still owned by Stanley Black and Decker, successor to the Stanley Works, once the centerpiece of New Britain’s hardware-manufacturing industry. Stanley will lease space to EIP.

The company plans “a high-performance computing center, data center, microgrid powered by Doosan fuel cells manufactured right here in Connecticut,” Wick said. The first phase is the fuel cell center on Curtis Street.

“This facility in this building will become the largest indoor fuel cell installation in the world,” Wick told a crowd of city officials, state lawmakers and business owners.

EIC next year will be moving Doosan fuel cells into the vintage 45,000-square-foot brick building, which was once Stanley’s hardware stamping plant. “We expect to have many people back at a ribbon-cutting at the end of 2020 when we’re commissioned and putting 20 megawatts out into the grid.”

Stewart acknowledged that the project created ill will among preservationists last year because it entailed demolishing more than a half-dozen Stanley buildings from the turn of the century.

“Every one was talking about getting rid of historic property and what that means to a community,” she said. “But to see this historic site being reused into something that’s going to absolutely benefit not just New Britain or the state of the Connecticut, but the entire region is going to be an incredible thing.”

A recent report from the Connecticut Conference of Municipalities offered welcomed news for city taxpayers, while property owners in other area cities and towns may be displeased with the findings.

According to the CCM, property tax rates increased in nearly 80 Connecticut municipalities for fiscal year 2019-20, according to an analysis released Aug. 26.

However, the Hardware City saw no property tax hike, while those living in the neighboring communities of Berlin, Newington and Bristol did not escape a tax increase.

Property tax hikes took place in 79 municipalities across the state; 59 of those 79 towns had tax hikes greater than the latest 1.6 % inflation rate reported for Connecticut.

The following are the changes in mill rates seen the area:

. New Britain’s mill rate remained the same at 50.5.

. Bristol’s mill rate increased from 36.88 to 38.05, a 3.17 % increase

. Berlin’s mill rate increased from 32.5 from 33.93, a 4.4 % increase

. Newington’s mill rate increased from 38.5 to 39.45, a 2.47 % increase.

. Plymouth’s mill rare increased from 39.69 to 40.63, a 2.37 % increase.

. Plainville’s mill rate increased from 33.84 to 34.62, a 2.30 % increase.

. Southington’s mill rate increased from 30.48 to 30.64, a 0.52 % increase.

“The need for adequate state aid to achieve significant property tax relief - along with other diversified local revenue sources and greater authority to contain local costs - is undeniable,” said Joe DeLong, CCM executive director and CEO. “Nearly 100 towns and cities were forced to increase their property tax rates because of cuts in some state aid programs, and in spite of sustained state aid in others areas for local governments.”

Thirty towns were able to sustain the same mill rate and 13 towns were able to slightly reduce their mill rate.

“We are proud to be among the handful of towns who were able to keep taxes down this year,” said Mayor Erin Stewart in a statement. “Balancing a $242 million budget and keeping services intact as residents have come to expect them is no easy task. It requires strong leadership, planning, sound fiscal management, and the ability to negotiate and work with a variety of parties. We will continue to pursue the creation of new revenue streams to help keep the tax rate down in the future. “

Statewide, local property taxes now total more than $11 billion, an increase of at least $500 million since 2017. That exceeds the state’s largest source of revenue, the personal income tax, which yielded nearly $10.8 billion in 2018 (the latest year for complete data).

“Some enhanced state aid enacted over the last several state legislative sessions has enabled some already high-tax communities to hold the line on property tax increases, or in some towns, to actually reduce taxes,” said DeLong. “Despite this, some communities still have extraordinarily high property tax rates. Relying on the property tax to continue to fund local government is unsustainable.”

The per capita property tax burden in Connecticut is $2,847, almost twice the national average of $1,518 and the third highest in the nation.

The property tax in Connecticut is depended upon to raise 72 percent of all local revenues.

State aid to municipalities in Connecticut still represents only 23.4 percent of municipal revenues; that is well below the national average of 32.9 percent, and ranks Connecticut 40th in the nation in state aid to local governments, the CCM reported.

And, Connecticut is one of only 15 states that limits municipalities to raise revenue only from the property taxes.

The New Britain Common Council voted 13-0 Wednesday night to authorize $57 million in bond authorizations for renovations at Chamberlain Elementary School and roofing projects at Slade and Pulaski Middle Schools.

Though the project was approved by the City, it still requires confirmation from state officials on whether they will reimburse the project, which is typically around the 80 percent rate. The cost estimate for Chamberlain is $49 million. Other costs include $1 million for temporary classroom space, $3 million for the replacement of a roof at Pulaski, $3 million for a roof replacement at Slade, and $1 million in financing costs.

“I’m proud to support this additional, substantial investment in our schools and children,” said Mayor Erin Stewart. “It is important that our children are provided with a safe and adequate learning environment. A special thank you also to state Rep. Robert Sanchez, Co-Chair of the Education Committee, for helping us make repairs to our aging infrastructure.”

The “renovate as new” Chamberlain project will address deficiencies in building space, program needs, site safety issues, community needs, and code compliance considering both present and future needs. Building spaces will be modernized with technology equipment in areas such as the media center and all instructional spaces including mobile computer carts, wireless access points and computer lab. Contemporary classrooms will be built with interactive whiteboards. The Chamberlain Campus also includes a 40-year old temporary portable building which houses four classrooms that will be demolished and incorporated into the main building.

The Chamberlain project will also involves making improvements to the site traffic pattern and adding additional parking spaces. An addition to the existing school will also be added to create new space for a school based health center and family resource center.

Chamberlain was originally built in 1952 and much of the original construction materials are still present in the classrooms; renovations and additions were made in 1993.

The funding request comes as work is wrapping up on a $48 million renovation of Smalley Elementary School in the North Oak area. The school will be completed in time for students this fall.

The Mayor states that the projects will not move forward until the City has received reimbursement from the state for the Smalley Elementary School renovation.

Standard & Poor’s Global Ratings Service (“S&P”) has affirmed the City of New Britain’s “A+” rating on both its new and underlying debt. At the same time, S&P has affixed its top short-term rating of “SP-1+” to the City’s short term debt obligations.

“Once again, Standard & Poor’s – the top rating agency in the nation – has graded our City ‘A+’ to the market at large,” said Mayor Erin E. Stewart. “When I took office back in 2013, we had been downgraded to ‘BBB,’ which was one step above junk bonds. In five years we have not only brought our rating back, but we have been consistently affirmed as being a strong ‘A+’ credit with a ‘Stable’ outlook. That is something in which I, and all of our residents, can take great pride.”

The report from S&P cited several factors contributing to the “A+” rating, including:

“Strong management: We view the City’s management as strong, with good financial policies and practices.”

“Very strong liquidity: In our opinion, New Britain’s liquidity is very strong…In our view, the City has strong access to external liquidity if necessary.”

At several points in their report, S&P cited the fact that the City has spent the past five years returning the budget to structural balance, taking into account many of the difficult – but necessary - decisions that have been made during Mayor Stewart’s administration, including: reducing City expenditures, reducing the size of the City’s workforce, finding or creating efficiencies where possible, hedging against downturns in state aid, hard-nosed negotiating with our partners in labor, close monitoring of expenses, and only raising revenues as a last resort.

“For five years I have made it clear that my first priority was, is, and always will be keeping our City on a path to fiscal stability,” the Mayor continued. “Every day we are working to increase both private and public investment in New Britain, continue the positive growth in our grand list, create an environment that is both attractive and predictable for families and businesses alike, and maintain the number and quality of services we provide to both.

“That’s certainly not to say everything is rosy. Returning a City this size to solvency requires striking a delicate balance day-by-by, month-by-month and year-by-year. Yes, we have made some difficult choices to restore stability and predictability to our finances. But many more tough decisions lie ahead. Whether it’s the uncertainty of a potential recession on the national horizon, or the uncertainty of the state’s financial position - along with a new administration and legislature in Hartford. But I am committed – and I believe our Council is as well – to making those decisions if they will keep us on a course to a brighter future, both in the near term and in the long term.”

Lori Granato, Director of Finance, said, “S&P acknowledges the City’s diligent work in order to meet the necessary services for our residents and our labor force. It’s not easy and involves a lot of difficult decisions. Collaboration continues to be the key so that the city continues to grow and prosper.”

Going forward, S&P stated: “The stable outlook reflects our view that New Britain’s reserves will remain strong, despite projected drawdowns, aided in part by a growing tax base. We also recognize that management has improved its budgetary assumptions over the past several years, which we expect will continue to lead to predictable performance. We do not anticipate changing the rating within our two-year outlook horizon as we believe it is likely that the City’s budgetary flexibility will remain strong and that the City will continue to pursue the goal of structural balance.”

Mayor Erin E. Stewart on Wednesday presented to the Common Council a$237.72 million budget for 2018-19 that calls for no tax increase and an overall reduction inspending.

The $237,729,089 budget represents a 1.58 percent decrease from the current year’s $241.53million budget. The Mayor received the Board of Finance and Taxation’s budget proposal onMarch 8. Under the Mayor’s plan, $13 million in changes were made, including $1 million incuts to the City side of the budget.

“This is a budget that preserves public safety, keeps education spending intact, retains an $18million fund balance, and maintains the services and quality of life that residents and businessowners have come to expect. It’s a budget that builds on our mission to find intradepartmentalefficiencies and guides us through a period of financial uncertainty at the Capitol in Hartford,”said Mayor Stewart. “I’d like to thank the Board of Finance and Taxation for all their hard workover the last several months. During that time, they heard in detail from department heads anddeveloped a proposal that aimed to strike a balance between funding our obligations andkeeping the mill rate down for taxpayers.”

The Mayor’s budget includes no layoffs or reduction in services, fully funds the City’s pensionobligations, factors in a 10 percent reduction in state aid, provides level funding to the Board ofEducation, and features an estimated savings from restructuring debt. Savings also come in partfrom the City’s 2017 Grand List increasing more than 5 percent.

“The Board of Education will receive the same amount of money from the City as they did lastyear, which is in line with the state mandate. While we realize this is not ideal, we are beingrealistic with the money we expect to receive from the state,” the Mayor stated.

The budget provides $125,700,000 in funding to the Consolidated School District of NewBritain. The school system was able to reduce its initial budget request by $1.64 million due to areduction in transportation costs related to going out to bid. The school board’s major requestedincreases included $1.40 million for salary increases and $2.1 million for increases in insurancecosts and fringe benefits.

“We understand that Superintendent Sarra is in the process of a massive restructuring of theschool district that will help save money,” Mayor Stewart said.

The budget proposal also accounts for more than $1 million in cuts on the City side, whichincludes:

-

A reduction in overtime in the Fire Department budget now that they are at fullstaffing levels

-

A reduction of four vacant patrol officer positions at the Police Department, nowthat the federal grant is no longer available

-

A reduction in apprentice positions within the telecommunications division

-

Trimming nearly every department’s budget to average historical funding levels,allowing the City to provide uninterrupted services